Navigating Open House Tours: A Home Buyer’s Guide

Navigating Open House Tours: A Home Buyer’s Guide

By Carma Stahnke

Open house tours are a crucial part of the buying process, giving you the chance to explore your options and envision your future in a new home. To make the most of your property visit, come prepared by following these important steps.

Do Your Research

Before attending an open house, do some research on the neighborhood, local amenities, schools and property values. This will help you make informed decisions and ensure that the location aligns with your lifestyle and preferences.

Create a Checklist

Buying a home is a big investment, so you want to create a checklist of your “must-haves” before you visit the property. Consider the number of bedrooms and bathrooms, the kitchen layout, the outdoor space and any other requirements. Having a checklist will keep you focused during the open house tour and help you evaluate each home objectively.

Prepare Your Financing

Understanding your financing options and budget is another key step in your home-buying journey. Getting pre-approved for a mortgage will empower you to make a strong and timely offer when you find the right residence. It also helps narrow your search so you can focus on properties within your price range.

Respect the Property

While touring homes, don’t forget that they are still someone else’s property. Avoid touching personal belongings, take your shoes off if requested and be mindful of the seller’s privacy. Remember that it’s in your best interest to make a positive impression, especially if you later decide to make an offer on the home.

Assess the Home From Top to Bottom

As you walk through the home, have your checklist handy and take notes for future reference. Keep an eye out for any red flags, such as cracks in the walls, outdated plumbing or older HVAC systems. Look under all the sinks and around bathtubs for mildew or water damage. And don’t forget the exterior – check the brickwork, siding, roof and balcony. Being fully aware of the home’s positive and negative aspects will be crucial when making your final decision.

Ask Questions

Don’t be afraid to inquire about the age of the property, recent renovations, maintenance history and any issues the current owners may have experienced. It might also be helpful to know how long the property has been on the market. This information will give you valuable insights into the condition of the home and allow you to assess potential future costs.

Following these steps, backed by the knowledge and guidance of your real estate agent, will help bring you closer to your goal of homeownership. Be sure to take your time, attend multiple open house tours and keep a detailed record. Happy house hunting!

Why Spring Is the Best Time To Sell Your Home

Why Spring Is the Best Time To Sell Your Home

By Michelle Abendschan

As winter ends, a burst of activity takes over the property market and potential buyers come calling. During this time, the housing market can also just look more appealing, accented with emerging greenery and the start of colorful blooms. Learn why spring is the best time to sell your home, and why this is prime time in the real estate world.

Peak Real Estate Activity

Traditionally, spring brings an influx of eager home buyers into the market, and that isn’t likely to change in 2024. With the holidays behind them and tax refunds in hand, people can be ready to make significant life changes – including finding a new home. This convenient timing can also give those new homeowners the summer to settle in before the kids start back at school. Plus, the increased housing demand in March, April and May often leads to quicker sales and more favorable offers – another big pro for home sellers in the coming months.

Spring is Open House Season

The less extreme weather also provides the perfect backdrop to showcase your home in its best light. With the milder temperatures kicking in for a lot of the country by mid-March and longer days ramping up everywhere, potential buyers can be more inclined to attend an open house, spotlighting your home’s warm and inviting atmosphere in-person.

Perfect Time for Home Improvements

The spring months are also ideal for touching up the exterior with a fresh coat of paint or fixing the roof if winter was a little rough on it. First impressions are super important to home buyers, and they’re more likely to fall in love with a home that looks well-kept and inviting. Nothing scares off a buyer faster than the thought of high-cost repairs down the line. So, start planning those tweaks and updates now.

Yards Look Their Best

Never underestimate the power of a picture-perfect home exterior. And that means curb appeal! Trimming the hedges, cleaning walkways or setting up a cozy front porch seating area can go a long way in convincing potential buyers to envision themselves living in and loving your home. This is also a fabulous time to consider all outdoor spaces. Landscaped yards and unique outdoor entertaining areas can make a lasting impact that will make them want to act fast.

Advantages of Listing with an Agent

If you do sell this spring, consider the benefits of working with a professional – specifically a Coldwell Banker® affiliated agent. From understanding the intricacies of your local real estate market to navigating the hyper-competitive spring selling season, they’ll have you covered. Plus, their expert marketing includes professional photography, targeted online advertising and more. Interested? Connect with an agent today to get started.

It’s true! Spring is the best time to sell your home. But here’s an insider tip – don’t wait for the rush to kick in. Dive in now, get ahead of the game and be ready to show when the market heats up.

How to Pet-Proof Your Home for Furry Family Members

How to Pet-Proof Your Home for Furry Family Members

BY MICHELLE ABENDSCHAN

If you share your home with a pet or two (or five), you know their well-being is a top priority. Along with making a move less stressful for them, learning how to pet-proof your home should be high on the list for responsible pet owners. Read on to know what to look out for and how to make your home a comfortable and secure place for everyone.

Kitchens

Star your pet-proofing mission in the kitchen, as it has a lot of potentially dangerous and tempting items for your four-legged friends. Ensure cabinets are secure to prevent access to cleaning supplies, cutlery and any unauthorized treats – child-proof cabinet locks are an excellent option here. Some human foods can be life-threatening for dogs and cats, so promptly store items like chocolates, crackers and leftovers away or you could be making an unexpected trip to the emergency vet. Garbage bins should have lids or be kept inside cabinets, as pets can get into trash hunting for a bonus meal.

Living Rooms

You probably spend a lot of quality time with your pets in your living room, which also deserves a careful going-over. Keep small objects, like breakable decorative pieces and children’s toys, out of reach. Electrical cords should be concealed or secured, as they present a chewing temptation for many animals. Certain houseplants can also be toxic for your fur babies, so you’ll want to eliminate any dangerous varieties.

Bedrooms and Bathrooms

In bedrooms, keep your clothes, shoes and personal items stowed away since anything can become a fun chew toy, especially for dogs. Secure medications, razors and other sharp objects away from curious paws and noses. And while a cat lying on the bathroom floor surrounded by a roll of unspooled toilet paper seems like it’d be great photo op, it’ll be a pain to clean up. Consider keeping doors closed when you’re not around.

Yards, Patios and Decks

If your pets spend considerable time outside, you’ll want to provide a shaded area and fresh water to prevent overheating in hot weather. Also, think about installing a pet door if you do have an enclosed outdoor space like a catio or dog run, making it easy for them to get outside safely. Plus, animals can be notorious escape artists, so securely latch all non-pet doors and windows to prevent any unexpected breakouts.

Create Pet-Friendly Spaces

Pet-proofing is not only about forbidden areas and potential harm – it’s also about making cozy and pet-specific areas for your animals. Your pets deserve to love their home as much as you do, so give them their own spots, like napping nooks and comfortable hiding places. Dogs might appreciate a snuggly bed in a quiet corner, while many cats love hanging out in a felted cat cave. Designate an area for pet toys, like a stylish basket or bin. This will make picking up a breeze and your pets will know where to go when it’s time to play.

Creating a safe environment by knowing how to pet-proof your home is vital to being a good pet owner. And with a little effort, you can make your house a haven for the whole family.

Top 5 Home Renovations with the Best Return on Investment

Top 5 Home Renovations with the Best Return on Investment

BY MICHELLE ABENDSCHAN

Well-planned home renovations can really enhance your home’s appeal and amp up its price when it’s time to sell. But not all improvements bring a hefty return on investment (ROI). Knowing the most promising updates can help strategize your revamping efforts for an attractive sale. Read on for a rundown of the top five home improvements likely to supercharge your property’s resale value.

Kitchen Upgrades

A modern, functional kitchen can impress prospective buyers and significantly boost your resale value. But a complete remodel isn’t always necessary when you’re looking for a sizable ROI. If your kitchen already has a good layout, work with what you have and make strategic changes. Key renovations to consider include new countertops, an updated backsplash, a fresh coat of paint, and high-end appliances. Need some swoon-worthy inspiration to get you in the mood? These kitchen updates will make you want to start taking notes and making plans.

Bathroom Remodels

Bathroom updates are next on the list of top ROI home renovations. Your efforts here can range from replacing dated fixtures to a more comprehensive refresh, including a new soaking tub or a sleek walk-in shower. But before you pencil in a new skylight and heated floor tiles, consider every tweak’s necessity and potential upside, as bathroom work – like kitchen updates – can quickly become expensive. But if you can invest more in this space, you’ll likely see significant returns.

Hardwood Flooring

There’s no question about it – adding or refinishing lackluster hardwood flooring can significantly enhance the value of your home. This type of flooring offers a timeless look that harmoniously blends with various design styles, from boho chic to classic elegance. Besides their aesthetic charm, hardwood floors are sturdy, easy to clean and healthier due to the absence of trapped allergens often found in carpets. Buyers are consistently willing to pay more for a house with hardwood, making this upgrade a wise choice if you can swing it. How much will wood floors cost you? It all depends on the size of your rooms, the style you choose and the tree species.

Eco-Friendly Improvements

Energy-conscious renovations have been in vogue for a while now. An energy-efficient home attracts a broad range of buyers and contributes to a greener, healthier environment for everyone. Energy-saving windows, LED lighting, Energy Star-certified appliances, higher-rated insulation, an updated HVAC system and solar panels can offer a higher selling price point and significant cost savings for the homeowner.

Adding an extra room or an outdoor living space

Expanding your total livable space can add considerable worth to your home, whether it’s a finished basement, attic or flex space. An additional bedroom or an office are always in demand, especially in this work-from-home era. If expanding indoors isn’t feasible, transform your outdoor area into a relaxing second living room. A deck or patio can be an enticing bonus for buyers looking for more usable square footage at the property. Swanky garage conversions can also provide extra room year-round with unique appeal.

The right home upgrades can substantially increase your property’s value. However, balancing your renovation budget with the prospective benefits is crucial. In addition to this list, research your market and pay attention to what features the top-selling homes in your area offer. Consulting a real estate professional can also help you make informed decisions and optimize your home renovations for the best ROI.

5 Advantages of Selling Your Home in the Fall

5 Advantages of Selling Your Home in the Fall

By Jennifer McGuire

While spring and summer are traditionally considered prime real estate seasons, the advantages of selling a home in the fall are often underestimated. Here are five compelling reasons why autumn might be the best time to list your property and make a big change.

Reduced Market Competition

Unlike the bustling real estate seasons, the fall landscape typically experiences less competition. With fewer properties vying for attention, your house could stand out more prominently, attracting serious buyers actively looking to make a purchase. This reduced competition can lead to a quicker sales process and even multiple offers. Active buyers in the fall can also be more motivated – their sense of urgency could work to your advantage.

Accelerated Transactions

With this cyclical lull, you’ll find a unique advantage in expediting your closing process. Mortgage lenders, attorneys, home inspectors and appraisers with reduced workloads can focus on ensuring your transaction glides along seamlessly. These factors often mean a swift and efficient closure, alleviating stress and providing a harmonious experience for all parties involved.

Favorable Timing

Aside from striking a balance between summer’s energetic buzz and winter’s slower pace, this period also offers a sweet spot for buyers who want to settle into their new homes before the holiday festivities kick in. Potential buyers can be eager to start the new year in a new home. By listing your house in the fall, you align with the natural rhythm of many people’s schedules, increasing the likelihood of attracting committed buyers.

Optimized for Comfort

In the cooler months, you can lean into your home’s cozy and inviting aspects in a way that might not work as well in summer. In addition to all-season staging tips, fall is a great time to make a fireplace the focal point of a room and style your interior to emphasize warmth and coziness. And no matter when you decide to sell your home, a fresh coat of paint is always a good idea, but in the coming months, consider a rich chestnut glow on an accent wall or a neutral cream with warm undertones.

Enhanced Curb Appeal

After the heat of summer, cooler weather can also provide a vibrant backdrop for showcasing your home’s curb appeal. Along with thoughtful staging inside, optimize the exterior for maximum interest. Seasonal landscaping and tasteful decor in moderation, such as pumpkins or an autumn-inspired wreath, can further accentuate your home’s charm and help potential buyers envision themselves living there. It’s also beneficial to run through a fall maintenance checklist for any updates needed before your house hits the market.

Yes, it’s true – the fall season presents many home selling advantages! From seasonal curb appeal to motivated buyers, this time of year offers unique opportunities for a highly successful transaction as you prepare for your new adventure.

How an Expert Can Help You Understand Inflation & Mortgage Rates

If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one.

Inflation and the Housing Market

This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the pinch at the gas pump and in the grocery store. It may have even impacted your ability to save money to buy a home.

While the Federal Reserve is working hard to lower inflation, the August data shows the inflation rate was still higher than expected. This news impacted the stock market and fueled conversations about a recession. It also played a role in the Federal Reserve’s decision to raise the Federal Funds Rate last week. As Bankrate says:

“. . . the Fed has raised rates again, announcing yet another three-quarter-point hike on September 21 . . . The hikes are designed to cool an economy that has been on fire. . .”

While their actions don’t directly dictate what happens with mortgage rates, their decisions have contributed to the intentional cooldown in the housing market. A recent article from Fortune explains:

“As the Federal Reserve moved into inflation-fighting mode, financial markets quickly put upward pressure on mortgage rates. Those elevated mortgage rates . . . coupled with sky-high home prices, threw cold water onto the housing boom.”

The Impact on Rising Mortgage Rates

Over the past few months, mortgage rates have fluctuated in light of growing economic pressures. Most recently, the average 30-year fixed mortgage rate according to Freddie Mac ticked above 6% for the first time in well over a decade (see graph below):

The mortgage rate increases this year are the big reason buyer demand has pulled back in recent months. Basically, as rates (and home prices) rose, so did the cost of buying a home. That pushed on affordability and priced some buyers out of the market, so home sales slowed and the inventory of homes for sale grew as a result.

Where Experts Say Rates and Inflation Will Go from Here

Moving forward, both of these factors will continue to impact the housing market. A recent article from CNET puts the relationship between inflation and mortgage rates in simple terms:

“As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.”

Sam Khater, Chief Economist at Freddie Mac, has this to say about where rates may go from here:

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, . . .”

While there’s no way to say with certainty where mortgage rates will go from here, there is something you can do to stay informed, and that’s connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting. They can provide you with the best advice possible.

Bottom Line

Rising inflation and higher mortgage rates have had a clear impact on housing. For expert insights on the latest trends in the housing market and what they mean for you, let’s connect.

The True Strength of Homeowners Today

The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are homeowners throughout the country? Mortgage debt grew beyond 10 trillion dollars over the past year, and many called that a troubling sign when it happened for the first time in history.

Recently Odeta Kushi, Deputy Chief Economist at First American, answered that question when she said:

“U.S. households own $41 trillion in owner-occupied real estate, just over $12 trillion in debt, and the remaining ~$29 trillion in equity. The national “LTV” in Q2 2022 was 29.5%, the lowest since 1983.”

She continued on to say:

“Homeowners had an average of $320,000 in inflation-adjusted equity in their homes in Q2 2022, an all-time high.”

What Is LTV?

The term LTV refers to loan to value ratio. For more context, here’s how the Mortgage Reports defines it:

“Your ‘loan to value ratio’ (LTV) compares the size of your mortgage loan to the value of the home. For example: If your home is worth $200,000, and you have a mortgage for $180,000, your LTV ratio is 90% — because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment. If you put 20% down, that means you’re borrowing 80% of the home’s value. So your LTV ratio is 80%.”

Why Is This Important?

This is yet another reason we won’t see the housing market crash. Home equity allows homeowners to be in control. For example, if someone did need to sell their home, they likely have the equity they need to be able to sell it and still put money in their pocket. This was not the case back in 2008, when many owed more on their homes than they were worth.

Bottom Line

Homeowners today have more financial strength than they have had since 1983. This is a combination of how homeowners have handled equity since the crash and rising home prices of the last two years. And this is yet another reason homeownership in any market makes sense.

Is the Real Estate Market Slowing Down, or Is This a Housing Bubble?

Is the Real Estate Market Slowing Down, or Is This a Housing Bubble?

The talk of a housing bubble in the coming year seems to be at a fever pitch as rising mortgage rates continue to slow down an overheated real estate market. Over the past two years, home prices have appreciated at an unsustainable pace causing many to ask: are things just slowing down, or is a crash coming?

To answer this question, there are two things we want to understand. The first is the reality of the shift in today’s housing market. And the second is what experts are saying about home prices in the coming year.

The Reality of the Shift in Today’s Housing Market

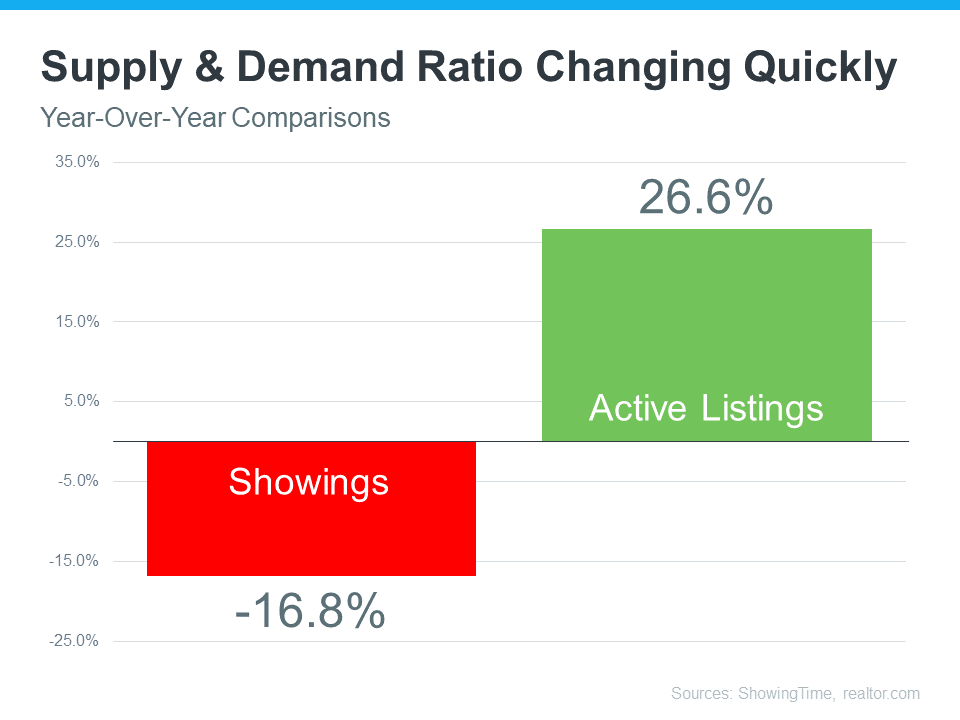

The reality is we’re seeing an inflection point in housing supply and demand. According to realtor.com, active listings have increased more than 26% over last year, while showings from the latest ShowingTime Showing Index have decreased almost 17% from last year (see graph below). This is an inflection point for housing because, over the past two years, we’ve seen a massive amount of demand (showings) and not enough homes available for sale for the number of people that wanted to buy. That caused the market frenzy.

Today, supply and demand look very different, and the market is slowing down from the pace we’ve seen. This offers proof of the sudden slowdown so many people are feeling.

What Experts Are Saying About Home Prices in the Coming Year

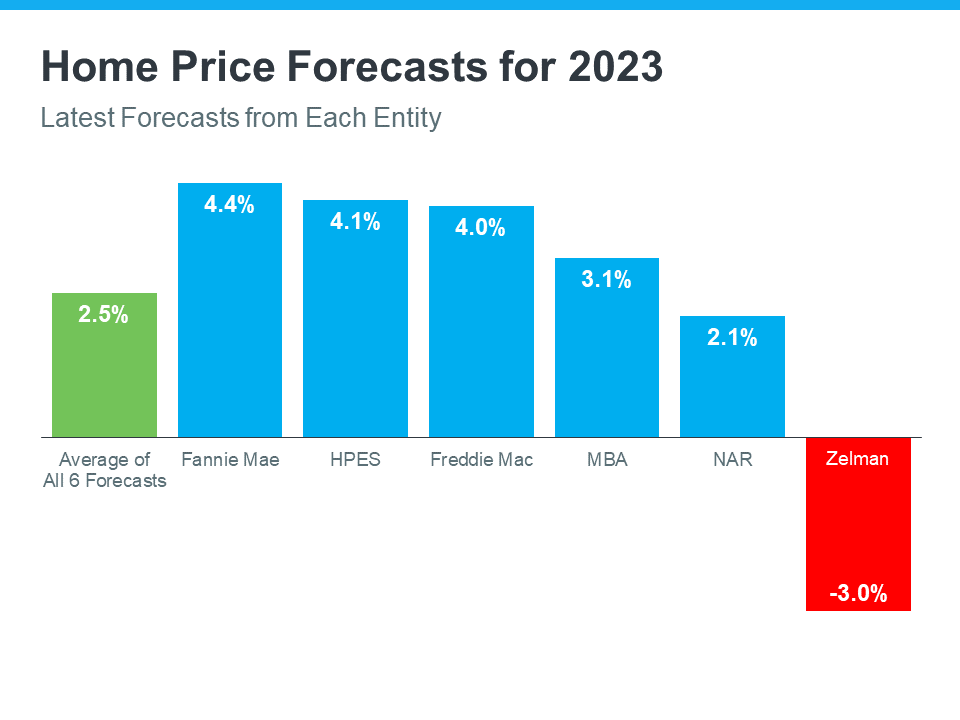

Right now, most experts are forecasting home price appreciation in 2023, but at a much slower pace than the last two years. The average of the six forecasters below is for national home prices to appreciate by 2.5% in the coming year. Only one of the six is calling for home price depreciation.

When we look at the shift taking place along with what experts are saying, we can conclude the national real estate market is slowing down but is not a bubble getting ready to burst. This isn’t to say that a few overheated markets won’t experience home price depreciation, but there isn’t a case to be made for a national housing bubble.

Bottom Line

The real estate market is slowing down, and that’s causing many to fear we’re in a housing bubble. What we’ve experienced in the housing market over the past two years were historic levels of demand and constrained supply. That led to homes going up in value at a record pace. While some overheated markets may experience price depreciation in the short term, according to experts, the national real estate market will appreciate in the coming year.

Three Things Buyers Can Do in Today’s Housing Market

Three Things Buyers Can Do in Today’s Housing Market

It’s clear the 2022 housing market has been defined by rising mortgage rates. With rates on the rise, it’s also become more costly to purchase a home. According to the National Association of Realtors (NAR):

“Compared to one year ago, the monthly mortgage payment rose to $1,944 from $1,265, an increase of 53.7%.”

If you’re thinking of buying a home or have been trying to recently, that’s a big increase in a monthly mortgage payment – and it may be causing you to press pause on your plans. This jump is making homes less affordable, especially compared to the last two years when mortgage rates were at historic lows.

The good news is you can navigate today’s housing market and this rising rate environment with a few simple tips. Here are three things you may want to consider to help make your homeownership goals a reality.

1. Expand Your Search Area and Criteria

If you’ve been looking for a home in the city center or a specific area that’s starting to feel out of your price range, you may want to try looking a little further out in a location that could be more affordable. Expanding your search location or re-prioritizing the items on your wish list can open up opportunities you haven’t considered, and that could help you afford more of what you need (and want) in a home. As CNET notes:

“Area growth is likely to keep pace with the market, which means that the outskirts of town might be hopping within five years. Consider stepping out of your ideal location by searching in the nearby cities. You may find better prices and more square footage.”

2. Explore Alternative Financing Options

Working with a trusted lender to learn about the different loan types and options is essential too. According to Nerd Wallet:

“A variety of mortgages are available with varying down payment and eligibility requirements.”

Experts know how to point you in the right direction when it comes to exploring ways to find the best home loan for your situation. With rising mortgage rates making it more costly to finance a home today, there may be an ideal option out there your loan officer can introduce you to. This could make a home purchase more affordable and within your financial reach over the life of your loan.

3. Look for Grants, Gift Funds, and Down Payment Assistance

There are also many options available when it comes to securing the funding you need to purchase a home. One valuable resource to explore is downpaymentresource.com. Searching for specific down payment assistance options available in your local community could be a game changer when it comes to taking your first step toward homeownership. As NAR indicates:

“Many local governments and non-profit organizations offer down-payment assistance grants and loans, targeted to area borrowers and often with specific borrower requirements.”

Plus, there are programs and special benefits for individuals working in certain professions or with unique statuses, including teachers, doctors and nurses, and veterans.

Ultimately, that means there are many federal, state, and local programs available for you to explore. The best way to do that is to connect with a local real estate professional and your lender to learn more about what’s available in your area.

Bottom Line

If you’ve been searching for a home and have found yourself stepping out of the process because you’re worried about rising costs, let’s connect. Having a team of local advisors on your side may be just what you need to guide your search in a new and more affordable direction.

Getting Your House Ready To Sell? Work with an Agent for Expert Advice

Getting Your House Ready To Sell? Work with an Agent for Expert Advice

In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – do before selling your house.

Here are some considerations a professional will guide you through.

What You Need To Know About Your Local Market

Since the supply of homes for sale has increased so much this year, today’s buyers have more options than they had last year. That may mean you’re not able to ignore some of those repairs or cosmetic updates you could have skipped in previous months. As a recent article from realtor.com says:

“To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.”

The key word here is selective. Since it’s still a sellers’ market, focusing on a few key areas may be enough to make your house stand out from other options. And since inventory is still low overall, it’s also possible buyers may be willing to handle the renovations themselves once they move in. It all depends on buyer demand and the available inventory in your local area. For advice on what’s happening in your market and what to do to make your house show well, lean on a professional.

Not All Renovation Projects Are Equal

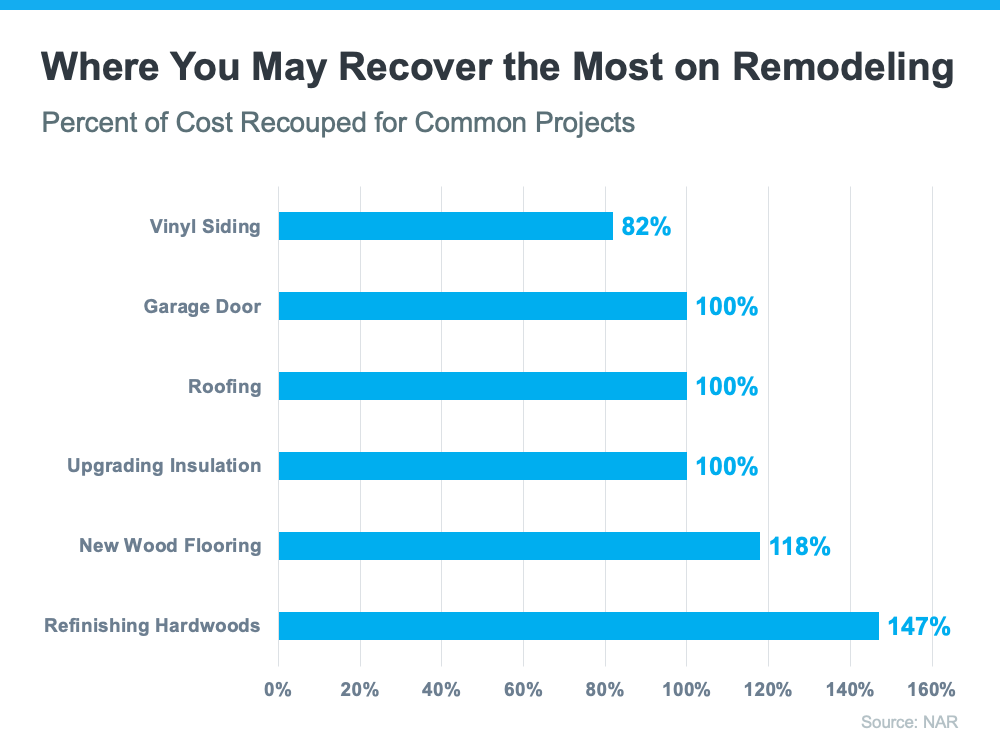

In addition to making sure your house makes a good first impression, you’ll also want to consider the return on your investment (ROI) for any renovations. According to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR), here are the projects that could net you the best return when you sell your house (see visual below):

Again, your real estate advisor is your best resource. When your agent comes to your house for a walk-thru and consultation, they’ll use their expertise to offer any insight into what you may need to repair, replace, or refinish. They also know what other sellers are doing before listing their homes and how buyers are reacting to those upgrades to help steer you in the right direction. As Dr. Jessica Lautz, Vice President of Demographics and Behavioral Insights for NAR, explains:

“This year, the winner was hardwood flooring. Hardwood floor refinishing and putting in new wood flooring had the most significant value, . . .”

How To Draw Buyer Attention to the Upgrades You’ve Made

For any projects you’ve already completed or for those you plan to do before listing, make sure your real estate professional knows. They’re not just an advisor to help you decide where to focus your efforts, they’re also skilled at highlighting any upgrades in your listing. That way, potential buyers know about the features that may help sell them on the house.

No matter what, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

Bottom Line

In today’s shifting market, it’s important to spend your time and money wisely when you’re getting ready to move. Let’s connect to find out where to focus your efforts before you sell.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link